Intricacies of Insurance Claims: In the domain of insurance claims, the figure of a loss adjuster assumes an urgent part in guaranteeing fair and precise settlements for policyholders and insurance organizations the same. These experts, frequently working in the background, are instrumental in surveying harms, researching claims, and arranging settlements. In this article, we dive into the universe of loss adjusters, unwinding their obligations, abilities, and the difficulties they experience in their profession.

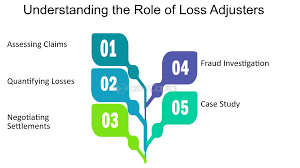

Figuring out the Job of a Loss Adjuster:

A loss adjuster, otherwise called a claims adjuster, fills in as a free middle person between the policyholder and the insurance organization. Their essential obligation is to research and survey the degree of harm under an insurance strategy. Loss adjusters are usually utilized in property and setback insurance, taking care of claims connected with occasions like flames, floods, mishaps, and other unexpected conditions.

Examination and Evaluation:

Loss adjusters are entrusted with completely researching the conditions encompassing a case. This includes evaluating the harms, gathering proof, and deciding the legitimacy of the case. The adjuster should have a sharp eye for detail and the capacity to examine complex circumstances to show up at a fair and exact evaluation.

Exchange and Settlement:

Endless supply of appraisals, the loss adjuster participates in dealings with both the policyholder and the insurance organization. Their point is to accomplish a settlement that is fair and OK to all gatherings included. This requires powerful correspondence and discussion abilities, combined with an exhaustive comprehension of insurance strategies and guidelines.

Documentation and Revealing:

Loss adjusters are careful in archiving their discoveries and making definite reports. These reports act as a pivotal reference for backup plans in coming to informed conclusions about the settlement. The capacity to express complex data unmistakably and briefly is a critical expertise for a loss adjuster.

Fundamental Abilities of a Loss Adjuster:

Scientific Abilities:

Loss adjusters need to investigate an assortment of data, including strategy subtleties, harm evaluations, and legitimate contemplations. Solid logical abilities are fundamental for getting a handle on complex circumstances and showing up at very much educated choices.

Correspondence and Discussion Abilities:

Powerful correspondence is fundamental in arranging settlements. Loss adjusters should be capable of passing data on to the two policyholders and guarantors, guaranteeing straightforwardness and understanding all through the claims cycle.

Scrupulousness:

The overlooked details are the main problem, and this maxim turns out as expected for loss adjusters. The capacity to see even the littlest disparities or subtleties in a case is essential to leading careful examinations and making exact evaluations.

Challenges Looked by Loss Adjusters:

Close to home Awareness:

Loss adjusters frequently manage policyholders who are going through genuinely testing circumstances, like the outcome of a cataclysmic event or a serious mishap. Offsetting compassion with objectivity is difficult for these experts.

Lawful and Administrative Changes:

The insurance business is liable to visit legitimate and administrative changes. Loss adjusters should keep up to date with these advancements to guarantee their appraisals and settlements line up with the most recent legitimate necessities.

Complex Claims:

A few claims include unpredictable conditions, like various gatherings, covering strategies, or questioned responsibility. Loss adjusters should explore these intricacies to show up at fair and just settlements.

Conclusion

All in all, the job of a loss adjuster is fundamental to the working of the insurance business. These experts overcome any barrier among policyholders and safety net providers, guaranteeing that claims are explored completely and settled fairly. With a kind mix of scientific, correspondence, and exchange abilities, loss adjusters explore the multifaceted scene of insurance claims, offering essential support amid hardship.

FAQs:

Here are some important FAQs:

How does a loss adjuster respond?

A loss adjuster is an expert mediator who examines and evaluates harms in insurance claims, haggling fair settlements among policyholders and backup plans.

What abilities are urgent for a loss adjuster?

Fundamental abilities incorporate solid insightful capacities, viable correspondence, and exchange abilities, scrupulousness, and the capacity to offset compassion with objectivity.

What difficulties do loss adjusters confront?

Challenges remember close-to-home responsiveness for managing bothered policyholders, remaining refreshed on lawful changes, and exploring complex claims including various gatherings or questioned risk. Fruitful treatment of these difficulties guarantees fair and simple settlements.